Cebuana Lhuillier Micro Savings: A Convenient Way to Save Money

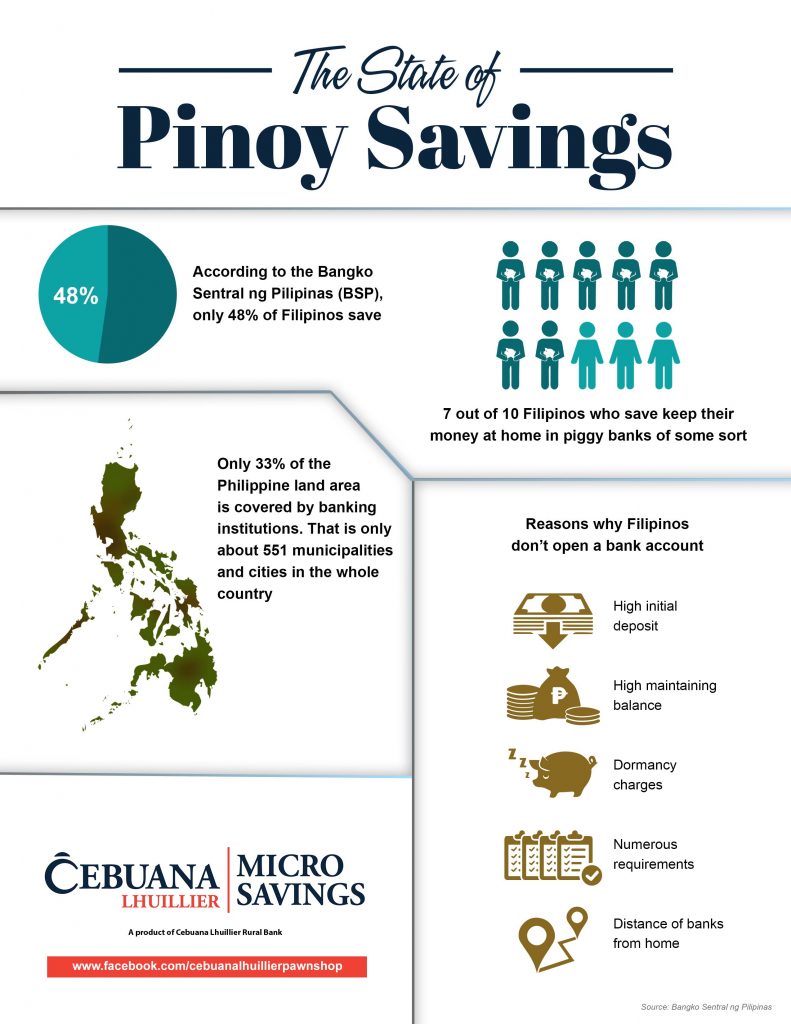

Many Filipinos opted to save money at home because of banking fears especially when an ordinary account holder could not afford to maintain the transactions in financial institutions and the bank will take away every single centavo left because of dormancy charges.

After successfully created a bank account with numerous requirements and high initial deposit, the next problem for a customer is the maintaining balance which is usually not below P3,000 or depending on the bank’s policy.

Also, bank operations usually opens at 9:00AM and closes as late as 4:30 PM. What if you what to immediately deposit your hard-earned salary or withdraw more than P20,000 (usual allowable withdrawal amount for a day)?

That’s what Cebuana Lhuillier, one of the country’s leading microfinancial services company, is trying to solve when they recently unveiled the Cebuana Lhuillier Micro Savings, which will provide Filipinos with a more convenient and affordable means to save their hard-earned money.

Acting as a cash agent of the Cebuana Lhuillier Rural Bank (CLRB), micro savings is Cebuana Lhuillier’s platform for Filipinos to overcome the barriers to saving.

Opening a Cebuana Lhuillier Micro Savings account requires only one valid ID and a minimal Php 50 initial deposit. And because of Cebuana Lhuillier’s wide network of branches comprised of 2,500 retail infrastructures, account holders can deposit and withdraw anywhere at their most convenient hours.

The product is in line with the Cebuana Lhuillier’s mission of financial inclusion, which has been the thrust of the company for the past 30 years.

Jean Henri Lhuillier, president & CEO of Cebuana Lhuillier

“With BSP’s basic deposit framework, Cebuana Lhuillier Micro Savings completes the full roster of our services, all designed and developed with financial inclusion in mind. We’ve come full circle—from offering collateralized loans or pawning, remittance service, micro insurance and now, micro savings—all of these products were designed with Filipinos from all walks of life in mind especially the unbanked and underserved, who would not have access to these financial services given their circumstances in life,” said Jean Henri Lhuillier, president & CEO of Cebuana Lhuillier.

Below are some frequently asked questions for Cebuana Lhuillier Micro Savings:

1. What is a Cebuana Lhuillier Micro Savings account? Cebuana Lhuillier Micro Savings is an interest-bearing savings product owned by Cebuana Lhuillier Rural Bank (CLRB). It is a savings account that allows clients to save up to Php 50,000 which can be accessed through the 24k card.

2. How did Cebuana Lhuillier Micro Savings come to be? Cebuana Lhuillier Micro Savings is Cebuana Lhuillier’s response to BSP’s call for financial inclusion. In 2018, the Bangko Sentral ng Pilipinas (BSP) released circular order 992 also known as the Basic Deposit Framework which eases the the process of opening a bank account. Through the circular, anyone can open a basic deposit account for less than Php100, with no maintaining balance and dormancy charges.

3. Are Cebuana Lhuillier branches authorized to receive savings deposits? As an accredited cash agent of the Cebuana Lhuillier Rural Bank (CLRB), Cebuana Lhuillier branches are authorized to offer and receive Micro Savings deposits. Cebuana Lhuillier branches serving as cash agents are authorized third party service providers of the bank, according to circular no. 940 of the Bangko Sentral ng Pilipinas which details the guidelines on deposit and cash servicing outside of bank premises.

4. Where can clients deposit and withdraw cash from their Micro Savings account? In any of Cebuana Lhuillier’s close to 2,500 branches nationwide.

5. What are Cebuana Lhuillier branches’ operating hours? Branches are open from Monday to Sunday. However, operating hours vary per branch. Visit cebuanalhuillier.com for the complete list of branches and their respective operating hours.

6. What are the documents required to open a Cebuana Lhuillier Micro Savings account? You only need one (1) photo-bearing government-issued ID, and Php50 initial deposit. For the list of valid IDs accepted by Cebuana Lhuillier, please refer to the list below:

- Alien Certification Of Registration (ACR)

- Birth Certificate (Applicable to minors only)

- Barangay Certificate or ID (w/ picture and signature)

- Company ID

- Driver’s license

- Dswd certificate

- GOCC ID (Afp, HDMF-Pagibig, Philhealth etc)

- GSIS E-Card

- IBP (Integrated Bar Of The Philippines)

- Immigrant Certificate Of Registration

- National Bureau Of Investigation (NBI) clearance

- Nat’l Council For The Welfare Of Disabled Persons

- OFW ID

- OWWA ID

- Passport

- Police clearance

- Postal ID

- Professional Regulation Commission (PRC) ID

- Seaman’s Book

- Senior Citizen’s ID

- Social Security System (SSS) ID

- Student ID

- Voter’s ID

- Firearm license

- Marriage license

7. What is the required minimum amount to open an account? A Php 50 initial deposit is the minimum amount needed to open an account.

8. Are there any transaction fees? There are no transaction fees for cash withdrawal and deposit.

9. What is the minimum amount of cash withdrawal and deposit? The minimum cash deposit is Php 50 while the maximum cash deposit is Php 50,000. For withdrawal transactions, the minimum amount is Php 100 and the maximum amount is Php 5,000.

10. How many transactions are allowed per day? Only three (3) successful transactions per card, per day are allowed.

11. Is there an average daily maintaining balance? There is no required maintaining balance for this type of account.

12. How long does it take before an account is considered dormant? There is no dormancy charge for this type of account.

13. How long do I have to wait before my account is opened? An SMS notification will be sent to the account owner containing the bank account number and temporary PIN, activating the account in real time.

14. Can I deposit or withdraw cash without my 24k Card? No. The 24k card is required for all Cebuana Lhuillier Micro Savings transactions.

15. Can I open multiple accounts? No. A client can only have one Micro Savings account.

16. Does the Micro Savings account earn interest? Yes, the Cebuana Lhuillier Micro Savings account earns interest per annum if the account has an average daily balance of Php 500.

17. How safe is my cash deposit in my Cebuana Lhuillier Micro Savings account? Your deposit is guaranteed safe in your Cebuana Lhuillier Micro Savings account. Cebuana Lhuillier branch personnel are fully trained and capable of handling finances with utmost care. Your account is also protected by a PIN that will always remain confidential. Also, all Micro Savings accounts are covered by the Philippine Deposit Insurance Corporation (PDIC).

18. What if I have further questions? You may contact Cebuana CARES team at cebuanacares@pjlhuillier.com or you may visit Cebuana Lhuillier’s Facebook page at facebook.com/CebuanaLhuillierPawnshop. You may also send an SMS to the following numbers: 0917-8122737 (Globe and Viber), 0918-8122737 (Smart) or call the following hotlines: (02) 779-9800 (PLDT), and (02) 759-9800 (Globelines)

We wish to try Micro Savings, we opened accounts today!

12 Comments

Melanie Herrera

I want to have that cebuana microsaving.it seems its covenient to use.

Jefftey Trinidad

1.Is there an interest when you open a savings account with you? 2. How many months for the savings account to be closed? 3. Can the cardholder can wothdraw funds in an ATM?.

Jessa Mae

Can i use cebuana microsaving for booking? Can cebuana micro savings accept payments from booking?

Divina Omas as

Pano ba pgkuha nag Pin code ng 24K plus card

Marijoie Shyne B. Berina

What if you reach the 50,000 ? It will increase after a year ?

Joey Pinlac

Possible bang mag deposit ang ibang tao sa microsavings account ko? Ng hindi na kailangan ng card ko???

alan denis tumabini

magkano po ang makukuha natinng interest pag nag deposit ako sa micri saving sa cebuana ng 15000 magkano lahat ang makukuha ko

Dolly saldua galope

Dear cebuana i open a newly account in microsavings but you don’t tx my pin # almost 1week n please text my new number that resend with your staff. Thank you

Rochelle Arevalo

Sana may fund transfer narin grom one microsaving to another. 🙏

Crisgonn Bayot

Pano po pag may magpapadala sakin? didiretso bayon sa 24k card? Concern student here

Jonalyn Estil

is there expiration in micro saving if not being used for months?

arvin abrigo evangelista

gusto q po sana ipagopen ang anak q ng acct.kaso wala aq hawak n id nya